Britain’s economic system has been described as “anaemic” by veteran enterprise editor Michael Wilson, who warned that inflationary pressures present no signal of easing.

His feedback come as main economists have issued stark warnings in regards to the nation’s financial trajectory, suggesting present insurance policies may spark a disaster harking back to the 1976 IMF bailout.

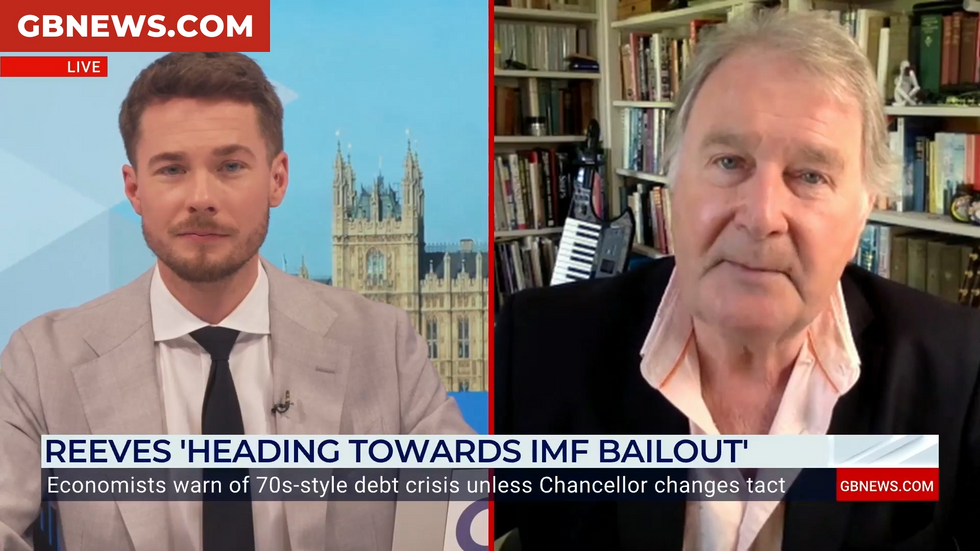

Chatting with GB Information, tv's longest serving enterprise and economics editor, advised GB Information: "Inflation has as soon as once more elevated way more than individuals anticipated.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

"A part of that is because of airfares, however a good portion is now pushed by meals.

"In line with the British Retail Consortium (BRC), meals retailers count on meals inflation that’s, the rise in the price of meals to stay pretty excessive, round 5 per cent, till the top of the yr.

So, I don’t see the Financial institution of England wanting to chop charges once more, because it did a couple of weeks in the past, right down to 4 per cent.

"Will it get decrease than that? I don’t suppose so. I count on we’re caught at that form of degree till the top of the yr.

"Inflation remains to be nicely above goal, and I don’t see any important fall in that in any respect."

GB Information host Alex Armstrong requested him: "What do you make of the issues that we could be heading towards stagflation?"

LATEST DEVELOPMENTS:

- Rachel Reeves 'pushing Britain towards 1976-style IMF bailout and economic collapse'

- 'Scrap the OBR!' Rachel Reeves referred to as to take motion as economic system trapped in 'doom loop'

- Relief for Rachel Reeves as UK public borrowing costs PLUMMET to lowest level in three years

He responded: "Definitely, stagflation that’s a interval of excessive inflation with none development within the economic system is an actual risk.

"The economic system is totally anaemic in the mean time, which is a giant warning signal.

"The Financial institution of England might want to intervene to assist individuals by reducing rates of interest, however I simply don’t suppose they may.

"I count on lots of ache over the following few months, and the largest affect, I’m certain, will come within the Autumn Finances."

Professor Jagjit Chadha, who beforehand led the Nationwide Institute for Financial and Social Analysis, warned that the economic system had approached the sting of "collapse."

"I'm in a world by which I may think about it [an IMF bailout] taking place, and we'll be bereft in that case," Professor Chadha advised Liam Halligan's "When the Details Change" weblog.

The previous NIESR chief outlined catastrophic penalties ought to such a situation materialise, stating: "We will be unable to roll over debt, we will be unable to fulfill pensions funds… advantages can be exhausting to pay out."

These warnings draw parallels to Britain's 1976 monetary disaster, when rampant borrowing and inflation compelled the nation to safe a £3billion mortgage from the Worldwide Financial Fund to stabilise sterling.