Householders making ready to resume a hard and fast charge mortgage might save a whole bunch of kilos by performing earlier than the tip of December.

Richard Moring, director of RM Mortgage Options, mentioned December is a powerful month for arranging a brand new deal as a result of exercise within the mortgage market usually slows.

He mentioned: "It's not a time of yr that you simply have a tendency to consider renewing your fastened charge mortgage deal, and that's precisely why it's a incredible time to do it".

The pre-Christmas interval is normally among the many quietest for mortgage functions, which might profit debtors who take motion sooner than most.

TRENDING Tales Movies Your Say

Mr Moring mentioned lenders usually have extra capability throughout December and might subsequently provide aggressive pricing and faster processing occasions.

He mentioned mortgage suppliers are eager to fulfill annual targets earlier than the yr ends, prompting some to launch enticing offers or streamline their inner procedures.

"Lenders have annual targets to fulfill and plenty of launch aggressive offers or streamline their processes to tempt prospects in, leaving them with doubtlessly important financial savings."

He mentioned this creates a chance for owners prepared to evaluate their funds throughout a quieter interval.

The lowered workloads at the moment of yr imply documentation may be dealt with sooner than throughout the busiest months, shortening typical turnaround occasions.

Mr Moring mentioned there’s another excuse to think about renewing a deal now quite than ready till January.

He mentioned lenders ceaselessly reassess pricing fashions within the new yr, and it is not uncommon for charges to rise within the first quarter.

Mr Moring mentioned: "They are going to usually reassess their pricing fashions in January and it's common to see value rises within the first quarter of the yr".

He mentioned securing a deal in December might assist households keep away from larger prices early subsequent yr.

"By placing somewhat time apart in December to safe your subsequent deal, it can save you your self lots of time, cash and stress in comparison with peak intervals."

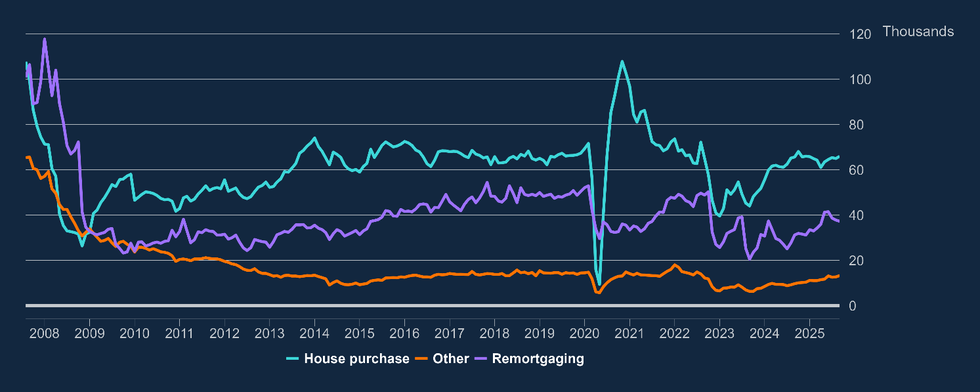

The Financial institution of England held rates of interest at 4 per cent final month, and the affect of this determination varies relying on mortgage kind.

A set charge mortgage units an rate of interest for the size of the deal, no matter future actions within the base charge.

LATEST DEVELOPMENTS

- Nationwide mortgage overhaul forward of Financial institution of England rate of interest determination – full record

- Financial institution of England points new replace for anybody with a mortgage forward of rate of interest determination

- Lloyds Financial institution to launch new £40,000 provide for purchasers from subsequent Friday – are you eligible?

This implies month-to-month funds stay the identical all through the time period.

A variable charge mortgage can rise or fall relying on choices made by the Financial institution of England.

Variable merchandise can provide decrease early-stage prices and permit for lowered funds if rates of interest fall.

They will additionally enhance funds with out warning if the bottom charge is raised.

Mounted charge offers stay the preferred alternative amongst debtors preferring certainty over month-to-month repayments.

Mr Moring mentioned fastened charge mortgage holders approaching the tip of their present deal could discover improved pricing accessible over the approaching months.

"For fastened charge mortgage holders coming in direction of the tip of their deal, there’s cause to be optimistic that charges will proceed to fall and there can be good offers to be discovered".

He mentioned many lenders provide debtors the power to safe a charge months earlier than their current deal ends.

Most lenders permit prospects to lock in a charge now that won’t begin for as much as six months.

He mentioned: "In apply, you’ll be able to safe a aggressive charge earlier than Christmas and if charges fall subsequent yr, you’ll be able to simply swap once more earlier than completion so that you get one of the best of each worlds".

The lighter workload throughout December also can result in faster doc processing.

"The paperwork tends to get accomplished extra shortly too with a lighter workload, so it's a win-win state of affairs".

Our Requirements: The GB Information Editorial Constitution