In Britain, checking the climate forecast is second nature. We obsessively seek the advice of our favorite climate app, able to adapt our day primarily based on whether or not sunshine or showers are predicted. However we perceive that climate forecasts grow to be much less dependable the additional out they go. If somebody claimed it might rain at precisely 10:13am two Tuesdays from now, would we imagine them? We would pack a brolly. However we actually wouldn’t rearrange our life round that exact time.

We perceive that climate forecasts are knowledgeable guesses. They deal in possibilities, not ensures – and culturally, we use them with that understanding. However in terms of financial forecasts, we appear to neglect this widespread sense fully.

Take this 12 months’s spring forecast from the Workplace for Finances Accountability (OBR). Headlines centered on a selected determine: the forecasted shift from a £9.9bn surplus to a £4.1bn deficit by 2029-30. The following political and media response centred fully on this very particular quantity. However grasp on – this can be a prediction in regards to the state of a really complicated financial system 4 years sooner or later. Frequent sense, and our expertise of the climate, tells us that certainly can’t be proper.

Nicely, the OBR agrees. In its 2023 forecast efficiency report, it wrote: “Single level financial forecasts of an unsure future are virtually sure to be incorrect – a single level forecast of an end result (such because the inflation charge subsequent 12 months, degree of GDP development in three years’ time, or for the scale of the fiscal deficit on the finish of a parliament) has nearly no likelihood of being right [my emphasis].”

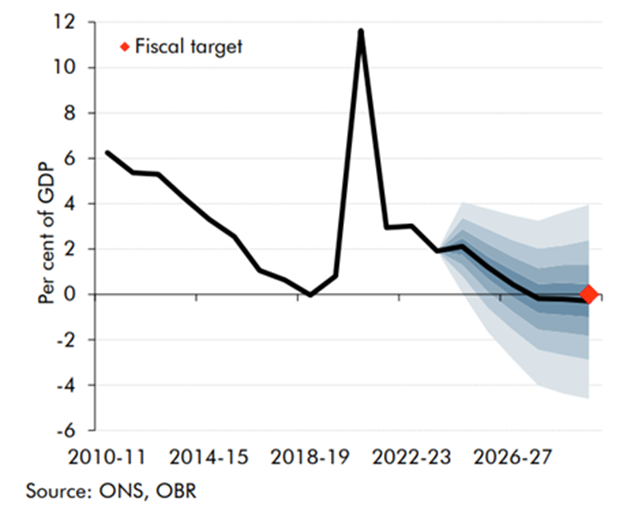

That is fully borne out by any have a look at the historical past of OBR (or certainly any financial) forecasts. A comparability of the forecast with what really occurred will present the folly of specializing in any particular quantity. So the place have these numbers come from and the way ought to we be utilizing these forecasts? Take into account the OBR’s personal chart (beneath) estimating the 2029-30 funds surplus or deficit.

It reveals, with 80 per cent chance, that the result could possibly be wherever between a 4 per cent surplus and a 4.6 per cent deficit of GDP – a swing of practically £300bn. But all the eye focuses on the central estimate: a £4.1bn deficit, which statistically has virtually no likelihood of being the ultimate end result.

This central estimate is basically the midpoint between extremes. It helps point out the centre of potential outcomes however treating it as a definitive prediction is misguided. It’s like listening to a forecast for rain at 10:13am in two weeks and basing all of your plans round that actual timing. That certainly can’t be proper. It could be extra affordable to say: “There’s a threat that the fiscal guidelines might be breached – we’ll adapt fiscal coverage accordingly if these traits agency up.”

One other subject is our obvious blindness to the inherent limitations of OBR forecasts. Once more, from the OBR’s personal report: “We are not any higher outfitted to see into the long run than different forecasters… We’re additionally topic to some constraints that many different forecasters are usually not, just like the authorized requirement to situation our central forecasts on said (fairly than anticipated) Authorities coverage.” That is key. The OBR doesn’t have particular data. It depends on publicly out there information and is restricted to modelling solely authorities insurance policies which might be totally detailed and formally in place when the forecast is made. In consequence, their forecasts typically miss main elements that may change financial circumstances considerably.

For instance, the OBR’s spring forecast couldn’t account for the federal government’s deliberate £113bn enhance in infrastructure spending, the commercial technique or the best funding in social housing because the Nineteen Seventies. Nor does it account for occasions that adopted, resembling Donald Trump’s proposed tariffs or new commerce offers. These omissions imply the forecasts are partial and outdated at the same time as they’re printed. Very similar to a climate forecast, these financial projections are simply snapshots. They provide insights, however they don’t seem to be – and shouldn’t be handled as – exact ensures to base our long-term coverage selections on.

A ultimate downside lies within the schedule itself. The requirement for 2 OBR forecasts per 12 months has led the federal government to successfully base its fiscal calendar round them. This 12 months, for instance, what seemed like a full fiscal occasion occurred through the Spring Assertion, regardless that the brand new Labour authorities had dedicated to just one main fiscal occasion per 12 months. Why? As a result of the OBR needed to produce a forecast, and the federal government felt it needed to reply with fiscal bulletins. Modifications to welfare coverage in response to the spring estimate are a stark living proof and coverage remains to be arguably being pushed by the idea that we should “rating” a selected quantity.

This back-and-forth between forecasts and coverage reactions creates volatility, fairly than stability. Each the Worldwide Financial Fund and the Institute for Authorities have advisable shifting to a single main forecast annually, aligned with the autumn Finances, to encourage coverage stability. This can be a smart change.

So what ought to we do? First, we should cease treating single-point estimates as gospel. They are often helpful, particularly to check completely different coverage choices, however they shouldn’t be handled as agency predictions of future outcomes. Second, we should always modify the best way we report and reply to forecasts – specializing in ranges and possibilities fairly than repeating misleadingly exact numbers. We should additionally clearly talk the inherent uncertainties and the constraints of the information used. Lastly, we should always transfer to 1 essential OBR forecast per 12 months, aligning it with the nationwide funds, and resist the temptation to craft coverage round forecasts that may possible be outdated by the point they’re acted upon.

In brief, let’s apply the identical widespread sense to financial forecasting that we do to climate forecasting. We don’t cancel weddings months out as a result of there’s an opportunity of drizzle, and we shouldn’t restructure fiscal coverage purely on the premise of a single quantity we all know to be, at best, an knowledgeable guess. As an alternative, we should always stay versatile. Financial forecasts are worthwhile instruments – however provided that we keep in mind what they’re: guides, not ensures.

[See also: Britain faces another showdown with the bond market]